Press Releases

MAGYAR TELEKOM RESULTS FOR THE THIRD QUARTER OF 2024

Budapest, November 13, 2024 17:30

Magyar Telekom today reported its consolidated financial results for the third quarter of 2024 , in accordance with IFRS Accounting Standards as endorsed by the EU. The quarterly financial report contains unaudited figures.

Highlights:

Total revenue increased by 13.8% year-on-year to HUF 246.1 billion in Q3 2024 . This improvement was attributable to the combined impact of continued strong demand for mobile data and fixed broadband services and the positive impact of the implemented inflation-based fee adjustment in Hungary. These increases were coupled with higher mobile equipment sales and an increase in SI/IT revenue, both reflecting favorable external impacts.

- Mobile revenue rose by 15.1% year-on-year to HUF 145.0 billion in Q3 2024 , driven by the continued growth in mobile data revenue and higher equipment sales.

- Fixed line revenue increased by 11.3% year-on-year, to HUF 77.4 billion in Q3 2024, reflecting the increases in fixed broadband and TV revenue driven by the customer base expansions as well as the favorable impact of the inflation-based fee adjustment applied to the Hungarian subscription fees.

- System Integration and IT (‘SI/IT’) revenue rose by 14.5% year-on-year, amounting to HUF 23.7 billion in Q3 2024, thanks to higher revenue from major projects at the Hungarian operation.

Direct costs were up by 11.1% year-on-year at HUF 94.4 billion in Q3 2024, primarily driven by higher equipment costs, parallel to the increase in sales.

Gross profit improved by 15.6% year-on-year to HUF 151.8 billion in Q3 2024, thanks to improvements in service revenue partly mitigated by the higher other direct costs.

Indirect costs were up by 9.4% year-on-year, at HUF 55.6 billion in Q3 2024, primarily driven by higher employee related expenses.

EBITDA increased by 19.5% year-on-year to HUF 96.2 billion in Q3 2024 driven by the improvement in gross profit. EBITDA AL was up by 21.3% year-on-year to HUF 88.7 billion in Q3 2024.

Depreciation and amortization (‘D&A’) expenses were lower by 2.2% year-on-year, amounting to HUF 34.0 billion in Q3 2024, driven by increases in the useful life of different asset classes.

Profit for the period rose by 86.4% year-on-year to HUF 45.9 billion in Q3 2024 driven primarily by the growth in EBITDA.

Profit attributable to non-controlling interests decreased by 15.6% year-on-year to HUF 1.4 billion in Q3 2024 , as improvement in the operational results at the North Macedonian subsidiary was offset by a one-off expense.

Capex after lease excluding spectrum licenses amounted to HUF 69.8 billion in the first nine months of 2024, representing a 4.2% reduction year-on-year, as lower annual CPE procurements in Hungary was coupled with lower network investments and seasonally lower TV content capitalization costs in North Macedonia.

Free cash flow, excluding spectrum license fees, amounted to HUF 108.5 billion in the first nine months of 2024 against HUF 48.6 billion in the first nine months of 2023. Year-on-year growth was attributable to the improved profitability and lower capex outpayments, partially mitigated by higher working capital needs related to different vendor outpayment dynamics.

Tibor Rékasi,

Magyar Telekom CEO commented:

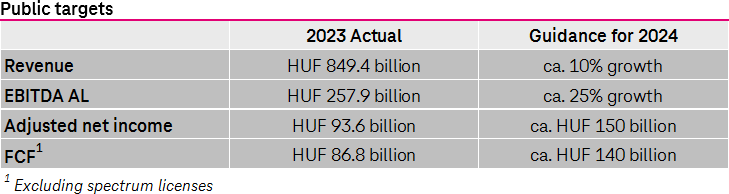

“Magyar Telekom’s impressive performance during 2024 continued through the third quarter, with our successful strategy, our customer-centric approach, and our ability to provide a gigabit experience, producing another strong set of operational and financial results. I am pleased to report that in the third quarter Magyar Telekom's revenue increased by 13.8% year-on-year, while EBITDA AL increased by 21.3%. We reached 94% readiness in the radio network modernization of our mobile network, and have now connected more than 1 million customers to our gigabit capable optical network. Alongside our network and technology focus, we have made further progress with our customer-centric approach. I am happy to report that one million customers are now benefiting from our Magenta Moments discount program, and in September we further improved both our fixed and mobile portfolios which now include the possibility of streaming add-ons. We have also just announced a major milestone in our domestic TV service as following the phasing out of satellite TV services from 2025, only interactive TV services will be available in our portfolio. Looking ahead, we can confirm financial guidance for full year 2024 across all metrics. ”

Public targets